In the world of renewable energy and project finance, hedging is an important risk management strategy that aims to reduce the impact of market volatility. However, hedging is not a foolproof strategy, and there are several ways it can go wrong. Here are six common ways that hedging can fail:

1. Not Understanding the Risks

One of the most critical factors in successful hedging is understanding the risks involved. This includes identifying potential risks that may be overlooked, such as a failure to anticipate a market downturn, regulatory changes, or natural disasters. Failing to understand the risks involved can lead to ineffective hedging strategies, which may result in significant financial losses. This can arise when the underlying risk has not been understood, for example if a hedge is fixed to 1M EURIBOR but a loan fixes at 6M EUIRBOR which creates basis risk, rather than mitigating risk.

2. Poor Risk Management Strategy

Having a solid risk management strategy is essential to successful hedging. A poor strategy can lead to hedging failures, such as not properly evaluating breakage costs, not diversifying the hedging portfolio, or not having a clear exit strategy. It's crucial to develop an effective risk management strategy that includes evaluating counterparty risk and other critical factors. This starts with identifying potential risks, quantifying them and understanding tools used to mitigate these risks.

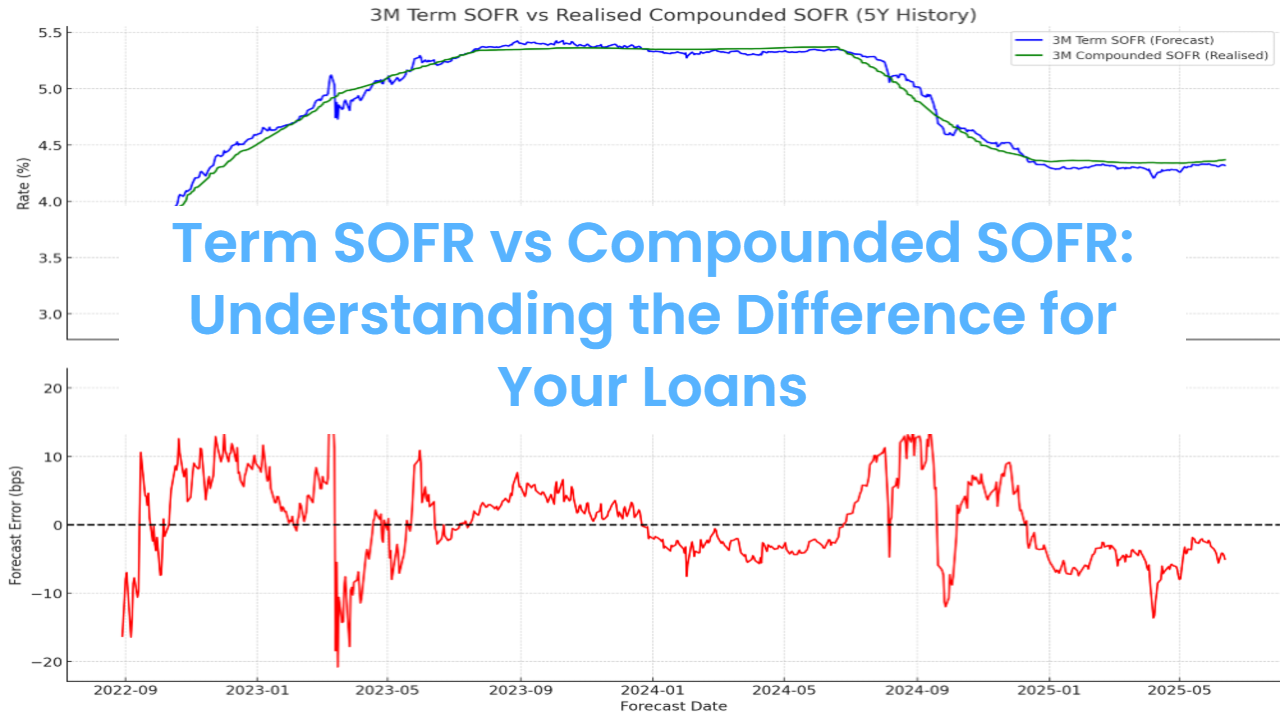

3. Over-reliance on Historical Data

While historical data can be helpful, relying solely on it can lead to ineffective hedging. Market conditions and dynamics can change quickly, and past performance may not be indicative of future results. To avoid this, it's important to incorporate other types of data, such as projections and scenario analysis, into hedging decisions

4. Failure to Consider Market Volatility

Considering market volatility is essential to effective hedging. Sudden changes in supply and demand, geopolitical events, or unexpected natural disasters can significantly impact hedging decisions. It's important to develop strategies that account for changes in supply and demand and other market fluctuations.

5. Hedging Too Late

Hedging in a timely manner is crucial to maximizing success. Failing to hedge at the right time can lead to missed opportunities and increased risk, such as failing to lock in favorable prices. To ensure timely hedging decisions, it's important to monitor market trends and conditions closely and match a hedge to a liability or an asset as closely as possible

6. Inadequate Monitoring and Adjustments

Monitoring and adjusting hedging strategies is critical to success. Inadequate monitoring and adjustment can lead to hedging failures, such as not adjusting for changing market conditions or not monitoring counterparty risk. It's crucial to monitor and adjust hedging strategies regularly to account for changes in the market.

Overall, effective hedging requires a deep understanding of the risks involved, a solid risk management strategy, and the ability to adapt to changing market conditions. By avoiding these common pitfalls, companies can increase the likelihood of successful hedging and manage risks more effectively.

.png)