We're putting together a swap rate news board and you can now join the waitlist! Fill in the form and you'll be the first to know when we go live!

What Are Swap Rates?

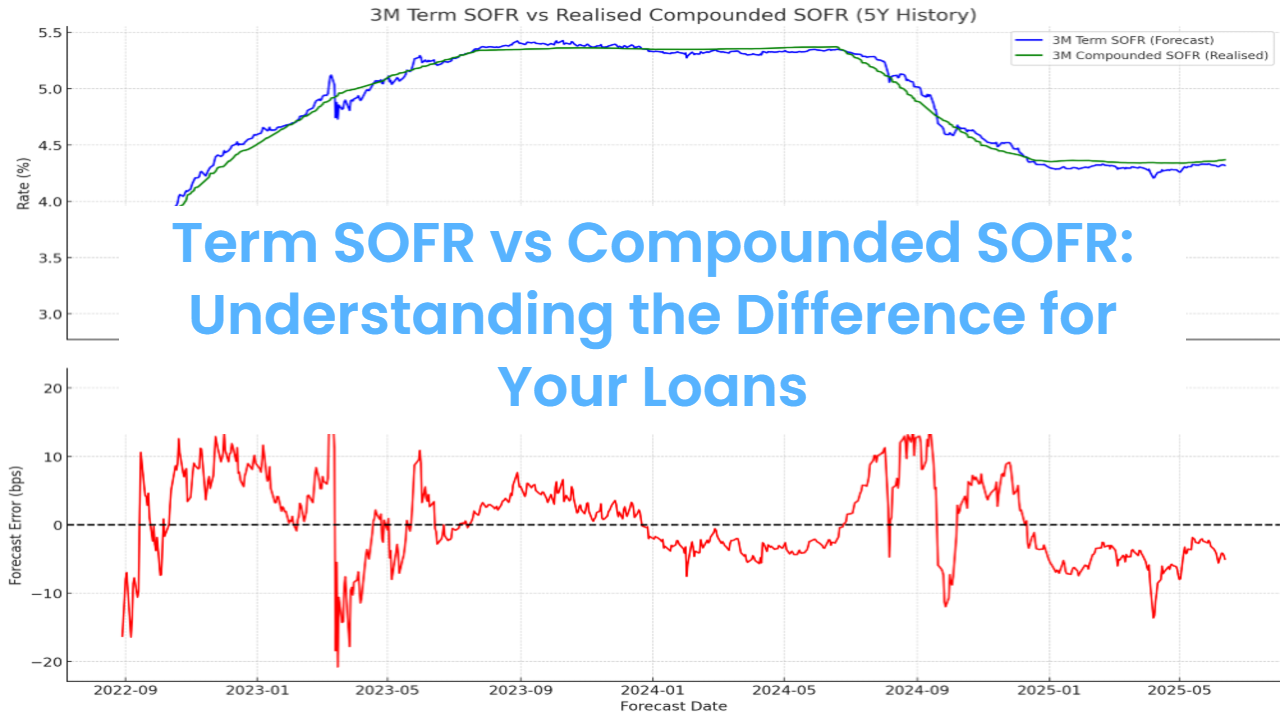

Swap rates reflect the market's expectations for future interest rates in a specific country or economic zone. They are calculated by taking a weighted average of forward interest rates over a particular period, such as EURIBOR, SONIA, or SOFR. Analysts use the forward curve to gauge how the market expects rates to change.

This makes swap rates a key indicator for understanding future interest rate trends and the factors driving historical rate movements.

What constitutes Swap Rate News?

Swap rate news includes any information or events that affect interest rate expectations—commonly referred to as economic events - both domestically and globally. Due to the broad range of topics involved, swap rate news can be challenging to find.

So, let's define economic events.

Economic Events are announcements, news, or developments that impact both financial markets and the broader economy. These events influence consumer confidence and thereby influence interest rates, exchange rates, inflation, and overall economic stability. In the context of swap rates, economic events are particularly important because they shape expectations for future economic conditions, which in turn affect interest rate swaps and other financial instruments.

Let’s look at what economic events that contribute to swap rate news:

Central Bank Announcements

Central bank announcements are among the most influential economic events affecting swap rates news.

- Scheduled but Unpredictable: While the dates of central bank meetings are known in advance, the exact content of the announcements is not. Analysts try to predict the outcomes based on available data, but surprises can still occur.

- Direct Influence: Central banks, like the Federal Reserve, the European Central Bank, or the Bank of England, set short-term interest rates to meet their inflation targets. When a central bank raises or lowers interest rates, it directly impacts the cost of borrowing and the yield on investments, which in turn affects swap rates.

- Forward Guidance: Swap rates are influenced not only by current interest rates but also by expectations of future rate movements. If a central bank signals a series of rate hikes or cuts, swap rates will adjust accordingly, often moving in anticipation of these changes.

- Predicting Future Policy: Central banks often provide forward guidance, indicating the likely path of future interest rates. This guidance shapes market expectations and can cause immediate adjustments in swap rates. For example, if a central bank hints at tightening monetary policy in the future, swap rates may rise as markets anticipate higher interest rates.

News

News plays a critical role in influencing swap rates as it provides real-time information on various factors that affect the economy and financial markets. The impact of news on swap rates is often indirect, as it reflects shifts in consumer and corporate sentiment, which in turn influence market expectations for interest rates.

- Geopolitical Events: Political instability, elections, trade wars, or military conflicts can cause uncertainty, leading to volatility in swap rates as investors adjust their expectations.

- Natural Disasters: Major natural disasters can disrupt economic activity, supply chains, and market confidence, impacting interest rate expectations and swap rates.

- Corporate Earnings: Significant earnings reports, especially from large companies, can shift market sentiment, leading to changes in swap rates if the reports suggest broader economic trends.

- Commodity Price Shocks: Sudden changes in the prices of key commodities like oil or gold can affect inflation expectations and thus influence swap rates.

- Credit Rating Changes: Upgrades or downgrades of sovereign or corporate credit ratings can influence perceived risk and borrowing costs, impacting swap rates.

- Public Health News: News of pandemics or widespread health crises can lead to economic slowdowns or shifts in monetary policy, influencing swap rates.

- Financial Market Crises: News of bank failures, financial institution collapses, or other market crises can cause rapid changes in swap rates as markets reassess risk and stability.

Data Releases

Regular economic data releases provide the market with information on the current state and future prospects of the economy. These releases are closely watched as they directly impact swap rates by shaping expectations about future interest rates.

- Inflation: High inflation readings can lead to expectations of rising interest rates, pushing swap rates higher.

- GDP Growth: Strong GDP growth signals a robust economy, which can lead to higher interest rates and higher swap rates.

- Labour Market: Employment data, such as job growth and unemployment rates, are key indicators of economic health. A strong labor market can lead to expectations of higher interest rates, impacting swap rates. In the US, a key labour market indicator is the non-farm payroll numbers.

- PMI (Purchasing Managers' Index): PMI data reflect the economic activity in the manufacturing and services sectors. Higher PMI readings can lead to expectations of economic expansion and rising interest rates.

- Consumer Spending: Data on consumer spending provide insights into economic activity and inflationary pressures. Increased spending can lead to higher inflation expectations and thus higher swap rates

Conclusion

Swap rate news is shaped by a wide range of economic events, from central bank announcements and geopolitical developments to data releases and market sentiment. Understanding these events is crucial for interpreting swap rate movements and anticipating future interest rate trends. By staying informed about the key factors influencing swap rates, investors and analysts can better navigate the complexities of the financial markets.

We're putting together a swap rate news board and you can now join the waitlist! Fill in the form and you'll be the first to know when we go live!

.png)