In this article we will explore the best Bloomberg Terminal alternatives for 2026, because while the Bloomberg Terminal is a powerful, comprehensive tool, its all-in-one nature comes with a hefty price tag. For many professionals, a better solution is to "pick and mix" from a new generation of specialised platforms. By assembling a suite of best-in-class alternatives, you can replicate the core features of a Bloomberg Terminal at a fraction of the cost, with more modern interfaces and focused functionality.

For Real-Time Market Data and Pricing

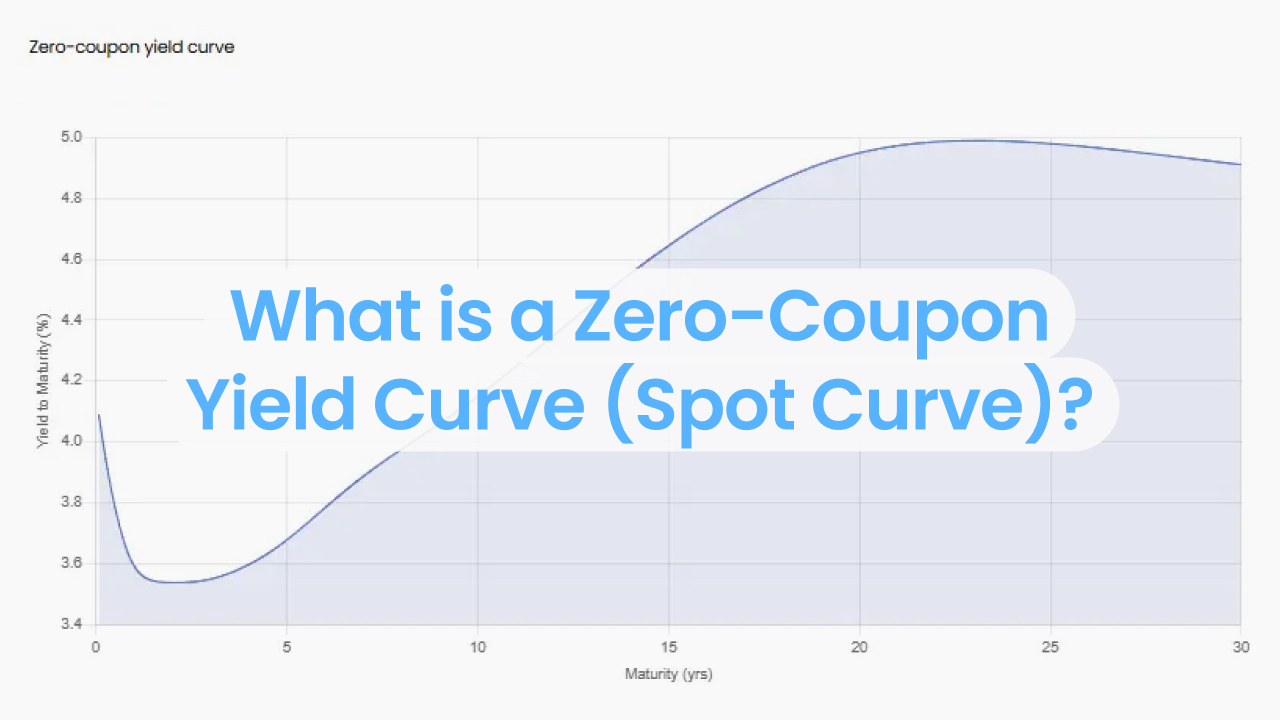

BlueGamma

Our platform is a specialised hub for financial professionals with a laser focus on interest rate data. We provide instant access to forward curves, swap rates, and inflation forecasts for over 25 global benchmarks like SOFR, EURIBOR, and SONIA. We built BlueGamma to be the tool we wished we had—a platform designed specifically for the needs of financing teams, energy companies, real estate investors, private debt funds, and treasury teams. It offers a clean, user-friendly web interface, a powerful API, and a seamless Excel Add-In, making it the ideal choice for anyone focused on debt modeling, forecasting interest costs, or managing floating exposures.

Pros

- Clean, Easy-to-Access Interest Rate Data: When you’re sizing debt for a new project or refinancing, you need forward curves that feed straight into your model—not a trading terminal. We deliver clean SOFR, SONIA, EURIBOR data via Excel or API so you can update lender packs in minutes. We provide timestamped, independent benchmarks that stand up in diligence.

- Seamless Excel & API Integration: Pulling live data shouldn't be a chore. Our native Excel Add-in and developer-friendly REST API allow you to integrate live forward curves and swap rates directly into your models and applications, eliminating manual updates and copy-paste errors.

- Unparalleled Specialisation: We focus exclusively on interest rate products and related derivatives. This specialisation allows us to provide highly accurate, clean, and timely data that financing teams can trust for critical tasks like debt sizing, hedging, and IRR calculations.

- Cost-Effective and Transparent: Forget opaque, six-figure contracts. We offer a simple subscription model that provides massive value without the bundled features you don't need. You can get started with a 14-day free trial to see the benefits first-hand.

- Global Benchmark Coverage: Our platform provides comprehensive data for over 25 global benchmarks, including SOFR, EURIBOR, SONIA, and CORRA, ensuring you have the necessary information for multi-currency financial modelling and analysis.

Cons

We are not a broad data provider; our deep focus is on interest rate products, so our platform is a specialised tool, not a full-suite data terminal.

Pricing

We offer a cost-effective subscription with a 14-day free trial. Plans start from £500 a month.

USP

Our unparalleled focus and accuracy on live interest rate forward curves and related financial derivatives, delivered through a platform built by finance professionals, for finance professionals.

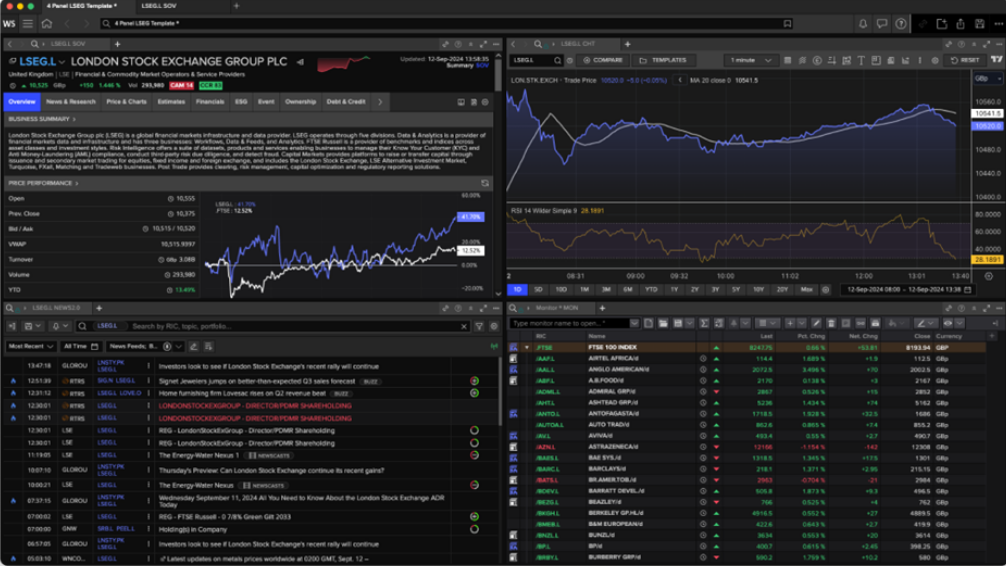

Refinitiv Eikon / LSEG Workspace

The most direct competitor to Bloomberg, Refinitiv Eikon (now part of LSEG Workspace) is an all-in-one platform providing extensive real-time data, analytics, and news for a wide range of asset classes. It's a comprehensive solution for traders, analysts, and wealth managers who need global market coverage and deep insights.

Pros

A direct competitor with vast data coverage, especially in fixed income and commodities, with seamless integration of Reuters news.

Cons

Can still be expensive and has a steeper learning curve than newer, more user-friendly platforms.

Pricing

Enterprise-level pricing. A single LSEG Workspace license is estimated to cost around $22,000 per year, though pricing can vary significantly based on the data packages and number of users. Some stripped-down versions are reportedly as low as $3,600/year.

USP

Unrivalled depth in certain niche markets and exclusive access to the Reuters news wire.

Koyfin

Koyfin is a modern, user-friendly platform that provides professional-grade financial data and beautiful data visualisations at a much lower price point. It's praised for its intuitive interface and is a great alternative for individual investors, analysts, and smaller firms who need powerful charting and fundamental data without the steep cost.

Pros

A modern, web-based platform with beautiful data visualisation and a free tier to get started.

Cons

Not designed for institutional-level trading and lacks the deep, granular data sets of its larger counterparts.

Pricing

Offers a free plan with limited features, with paid plans starting at around $39 per month, making it highly accessible.

USP

A powerful, user-friendly interface that democratises professional-grade financial data visualisation.

TradingView

TradingView is a web-based charting platform and social network for traders and investors. It is renowned for its advanced, intuitive charting tools that cover a vast universe of assets, including real-time stock prices, forex, and cryptocurrencies. The platform connects to hundreds of data feeds and more than 100 global stock and futures exchanges.

Pros

Superior charting capabilities with a vast library of indicators and drawing tools, a large and active social community for sharing ideas, and a freemium model that makes it highly accessible.

Cons

The free and lower-tier plans have delayed data for many markets; official real-time data for specific exchanges requires additional monthly fees on top of a paid subscription. Its core strength is charting and community, not deep fundamental data or analytics.

Pricing

Tradingview offer a free, ad-supported Basic plan. Paid plans (Essential, Plus, Premium and higher) range from about $13 to $200 per month and unlock more features like multiple charts, more indicators, and faster data. Real-time data packages for specific exchanges are an additional cost.

USP

The most popular and powerful web-based charting platform combined with the world's largest social network for traders, making technical analysis accessible to everyone.

For Real-Time News and Analysis

Financial Juice

Financial Juice is an innovative news and data platform that combines an AI-powered audio squawk with human analysis. It has gained significant popularity for its powerful free tier, which provides broad access to market news. The platform also features social elements, allowing users to share insights, and offers unique tools like a "Fed speech scanner" that analyzes central bank commentary in real time.

Pros

A powerful free tier makes it highly accessible. It uniquely blends AI-driven speed with human oversight and offers innovative tools and a community aspect.

Cons

While the AI is fast, it may lack the nuanced interpretation of a purely human-staffed squawk service on complex events. Premium features require a paid subscription.

Pricing

Offers a very comprehensive free tier. Paid "Zero" and "Pro" plans unlock advanced features like lower latency and more analytics, starting from around $207 per quarter.

USP

Its "freemium" model, which democratises access to a real-time audio squawk, combined with its innovative use of AI and community features.

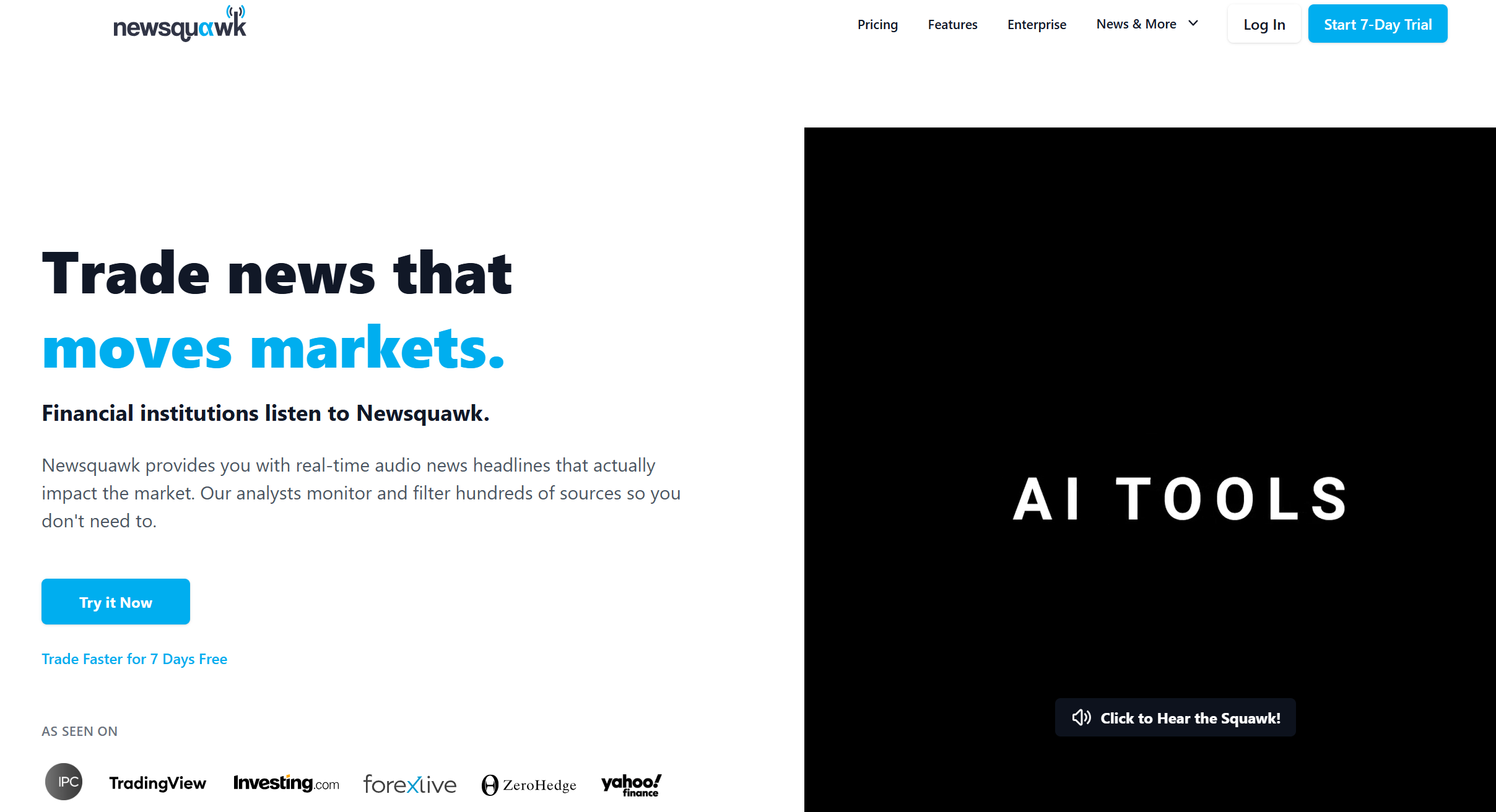

Newsquawk

Newsquawk is a leading audio "squawk box" service that delivers real-time, human-filtered market news and analysis directly to traders. Staffed by reporters in London, New York, and Singapore, it provides 24-hour coverage, ensuring traders hear critical breaking news, earnings, and central bank commentary the moment it happens. The service is known for its speed and for providing actionable context, often highlighting subtle but important nuances that automated feeds might miss.

Pros

A highly respected, low-latency audio feed with human analysts providing instant context and filtering out noise. It covers all major asset classes and is considered an institutional-grade service.

Cons

It's a premium, specialised tool that requires a separate data or charting platform for full context. It is one of the more expensive squawk services on the market.

Pricing

NewSquawk offers single asset class subscriptions starting at around £174 per month, with full, multi-asset coverage costing £349 per month.

USP

Its team of human reporters provides an invaluable, low-latency audio feed that allows traders to react to news without taking their eyes off their screens, complete with instant, expert analysis.

Benzinga Pro

Benzinga Pro is a real-time news and alerts platform tailored for day traders and active investors. It's known for its rapid delivery of market-moving headlines and its audio "squawk box" that allows traders to stay informed without having to constantly monitor the screen.

Pros

Extremely fast, real-time news delivery with an audio "squawk box" for traders.

Cons

Its focus on speed means it can lack the in-depth reporting and macroeconomic analysis found in a full news wire.

Pricing

Tiered plans start at around $37 per month for basic features, with more advanced plans at $197 or more, making it affordable for individual traders.

USP

Blazing fast, audio-based news delivery and a focus on market-moving headlines.

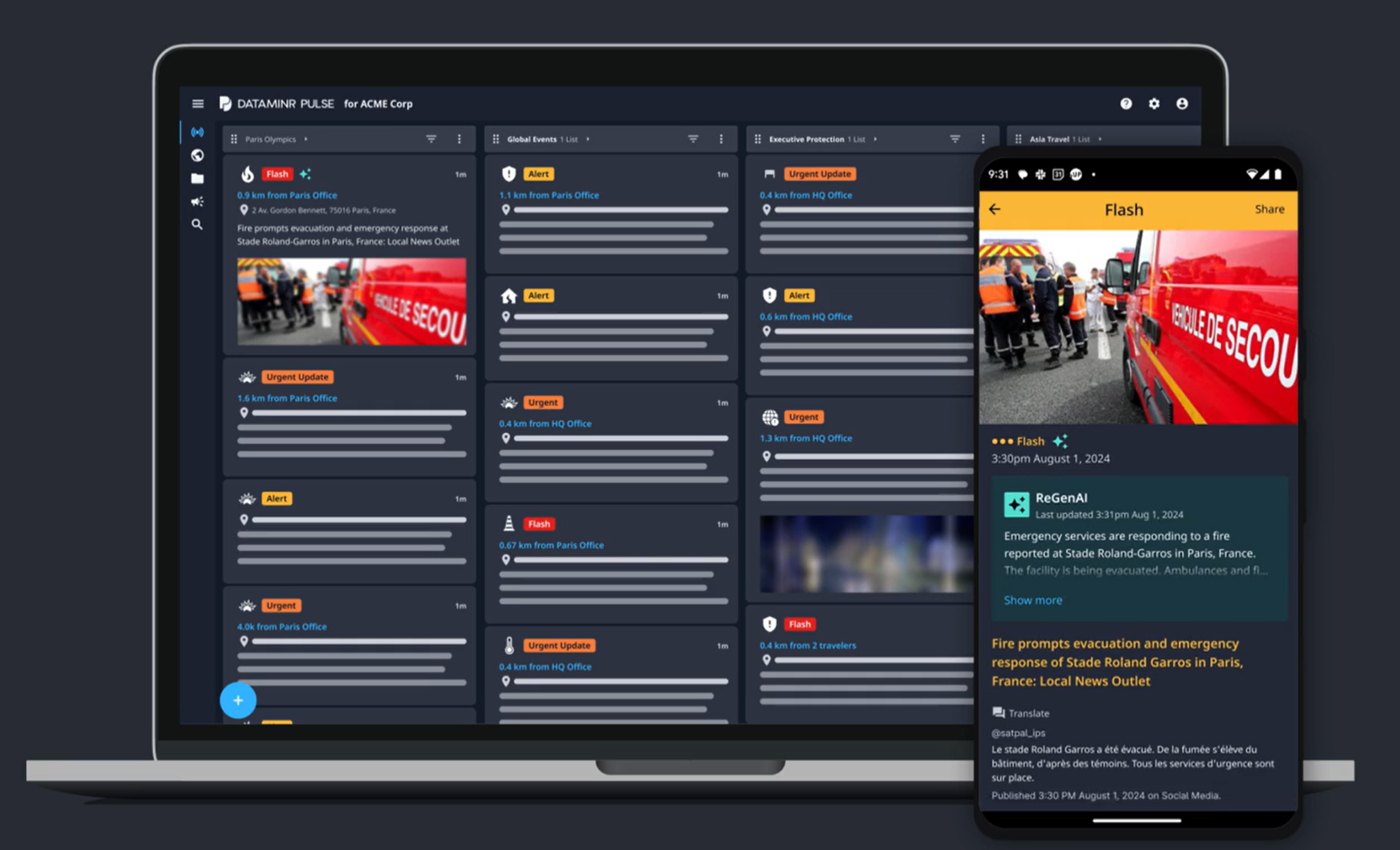

Dataminr

Dataminr is an AI platform that detects the earliest signals of high-impact events and emerging risks from publicly available data. It analyzes billions of data inputs daily from sources like social media, blogs, and sensors to provide real-time alerts to corporations, governments, and newsrooms.

Pros

Often delivers the earliest possible warnings of breaking events, sometimes ahead of traditional news sources. Its AI platform processes a massive amount of multi-format public data.

Cons

Can be very expensive, and its focus on public data means it may require interpretation and verification.

Pricing

Pricing isn't published on their website, but sources such as Capterra suggest pricing starts at $15,000 annually and AWS Marketplace reporting $30,000 per year.

USP

Its AI-powered platform provides the "gold standard" for fast, accurate real-time information on breaking events, enabling quicker response.

Dow Jones Factiva

Dow Jones Factiva is a comprehensive business information and news database. It provides access to a massive archive of over 33,000 global news sources, journals, and company reports, making it an excellent tool for in-depth research and background checks.

Pros

A massive archive of over 33,000 global news sources, journals, and company reports.

Cons

It's a research database, not a real-time trading tool, and its search interface can feel dated.

Pricing

Varies greatly based on access and usage. According to vendr.com pricing is around $2,600 per year.

USP

Its unparalleled depth and archive of global news and business information.

For Analytics and Research Tools

S&P Capital IQ

S&P Capital IQ is a research platform that excels in providing deep company financials, transaction data, and private company information. It's widely used by investment banking, private equity, and corporate finance professionals for due diligence and valuation.

Pros

Strong in credit analysis, corporate finance, and private company data.

Cons

Not as comprehensive for real-time market data or trading as Bloomberg. It can be expensive, with users noting aggressive annual cost increases and a dated user interface.

Pricing

Custom enterprise pricing, with vendor.com quoting $44,000 per year.

USP

Its deep focus on credit, private companies, and a global network of expert research.

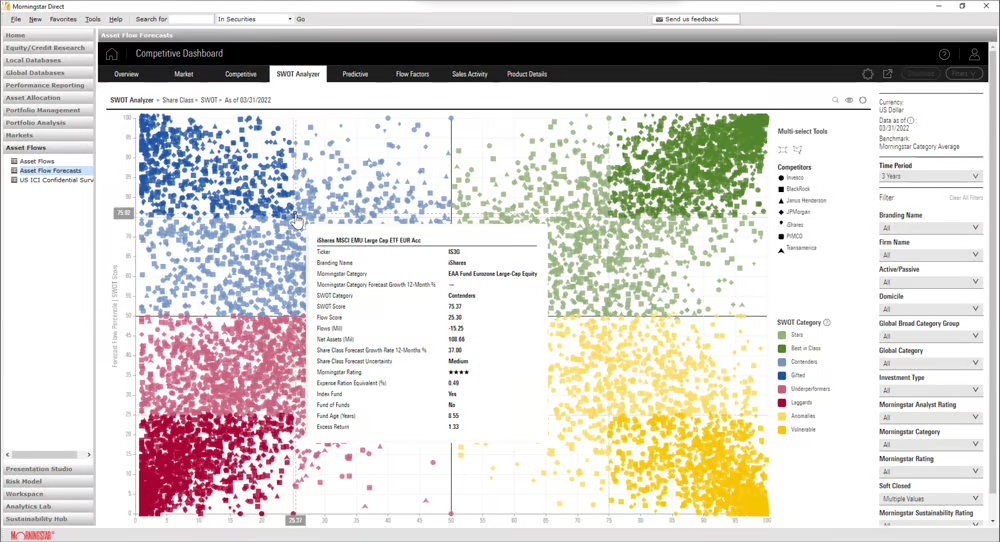

Morningstar Direct

Morningstar Direct is the industry standard for investment research, with a strong focus on mutual funds, ETFs, and asset allocation. It provides powerful portfolio analytics and ESG data, making it an essential tool for asset managers and wealth advisors.

Pros

The industry standard for mutual fund and ETF research, with powerful portfolio analytics and ESG data.

Cons

Lacks the multi-asset and trading-focused features of a full data terminal.

Pricing

According to Saasworthy.com pricing starts around $17,500 for a single annual license, with discounts for additional users.

USP

Unrivaled in-depth analysis and data for funds, ETFs, and asset management.

For Communication and Networking

Symphony

Symphony is a secure and compliant messaging and collaboration platform built for the financial services industry. It has become a widely used alternative to Bloomberg's native chat, allowing professionals to communicate within and across firms while meeting strict regulatory requirements.

Pros

A secure, compliant, and widely adopted messaging platform built specifically for the financial industry.

Cons

Lacks the direct integration with a data terminal that Bloomberg's native chat provides.

Pricing

vendor.com quotes a median buyer paying $4,800 a year.

USP

A powerful, secure network that is quickly becoming the industry standard for compliant communication.

For API and Excel Integrations

BlueGamma

We offer both a specialised API and a dedicated Excel Add-In to give you direct access to our proprietary interest rate data. This allows you to pull live forward curves, swap rates, and inflation data directly into your financial models, treasury software, or custom applications, enabling seamless updates and automation without ever leaving your preferred environment.

Pros

Seamless Excel & API Integration: We eliminate the hassle of manual data entry. Whether you're using our =BlueGamma.FORWARD_RATE() function in a spreadsheet or calling our versioned endpoints, you get live, reliable data synced every five minutes.

Unparalleled Specialisation: Forget sifting through irrelevant data fields. Our API provides direct access to the specialised interest rate and derivatives data that is crucial for accurate financial modeling, valuation, and risk management.

Cost-Effective and Transparent: Access institutional-grade data without the institutional price tag. Our clear, per-user subscription model makes powerful data integration affordable and predictable.

Global Benchmark Coverage: Our API and Excel Add-in cover over 25 global benchmarks. This allows for robust, multi-currency analysis and ensures your models reflect a comprehensive view of the market.

Cons

We are not a broad data provider; our deep focus is on interest rate products, so our tools provide specialised market data.

Pricing

We offer a cost-effective subscription with a 14-day free trial. Plans starting from $500 a month.

USP

Our unparalleled focus and accuracy on live interest rate forward curves and related financial derivatives, delivered through an easy-to-use API and Excel Add-in designed specifically for financial modellers.

Refinitiv Eikon / LSEG Workspace

Similar to its data terminal, LSEG Workspace offers a comprehensive API and robust Excel add-ins. This allows users to pull a wide range of real-time and historical data directly into their own models and applications, providing a powerful and flexible data source for institutional users.

Pros

Offers robust Excel add-ins and a comprehensive API for a wide range of asset classes.

Cons

The learning curve for its API can be steep for new users, especially compared to the simpler web-based APIs.

Pricing

API access is often included in enterprise-level subscriptions but may require a separate licensing agreement.

USP

Provides a truly global, multi-asset class data feed via a professional API, making it a viable replacement for the Bloomberg API.

Yahoo Finance Python Wrapper

yfinance is a popular open-source Python library that provides a simple way to download financial data from Yahoo Finance. It is not an official Yahoo API, but a wrapper that scrapes the publicly available data, making it a favorite for developers, students, and hobbyists who need free data for personal projects or back-testing.

Pros

It is completely free, easy to install and use, and provides a wide range of data including historical prices, fundamentals, and options.

Cons

Since it's not an official API, it can be fragile and break if Yahoo's website changes. It's not suitable for production or enterprise use and has limitations on data frequency.

Pricing

Free

USP

The go-to, no-cost solution for academic and personal projects that require an easy-to-use financial data source.

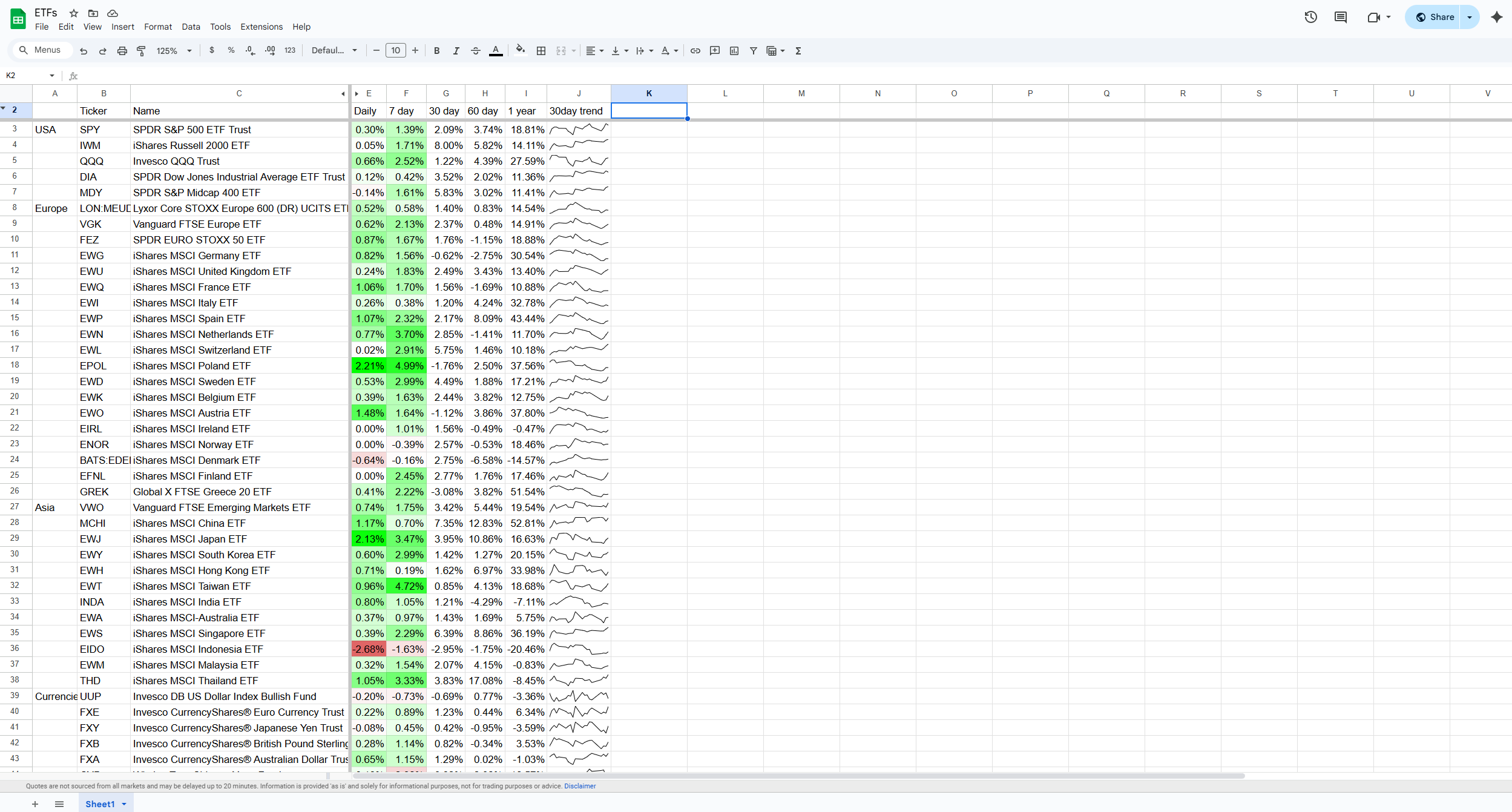

Google Sheets' GOOGLEFINANCE Formula

The GOOGLEFINANCE function is a built-in formula in Google Sheets that allows users to retrieve real-time and historical financial data directly into their spreadsheets. It's a simple, code-free way to track stock prices, currency exchange rates, and other basic financial metrics, making it a popular choice for personal portfolio tracking and small-scale analysis.

Pros

It's completely free, requires no technical setup, and is extremely easy to use for simple data retrieval.

Cons

The data is often delayed by 15-20 minutes, its coverage is limited to public companies and basic metrics, and it is not a robust solution for large-scale or high-frequency data needs.

Pricing

Free.

USP

The most accessible, user-friendly, and completely free way to pull basic market data into a spreadsheet without any coding.

EODHD Financial Data

EODHD (EOD Historical Data) is a powerful and affordable financial data provider offering a suite of flexible APIs and a spreadsheet add-in. It provides access to a massive dataset covering fundamentals, end-of-day and intraday prices, options, and economic data for a huge range of global assets, making it a favorite for developers, fintech companies, and individual investors building custom applications. The service covers over 150,000 tickers from more than 70 global stock exchanges.

Pros

Extremely cost-effective compared to institutional providers, with broad coverage of global stocks, ETFs, mutual funds, and forex. Its well-documented APIs are highly flexible and easy for developers to integrate.

Cons

While it offers real-time data, it may not have the same ultra-low latency as more expensive, specialised trading feeds. It is primarily a raw data provider, requiring technical skills to implement.

Pricing

Offers a free tier for testing. Paid plans are highly competitive, starting from around $20 per month for end-of-day data and scaling up based on the type of data (real-time, fundamental) and API call limits.

USP

Its unparalleled combination of affordability and vast data coverage makes it one of the best value-for-money data sources for building custom financial tools and applications.

NewsCatcher API

NewsCatcher is a specialised news API that allows developers to integrate real-time, structured news data into their applications. It scours thousands of global sources, providing a powerful, searchable database of articles that can be filtered by topic, company, country, language, and more. It's designed for use cases like media monitoring, sentiment analysis, and tracking market-moving stories.

Pros

Highly focused on news data, making its search and filtering capabilities very powerful and specific. It is developer-friendly with clear documentation, is easy to integrate, and is far more cost-effective than accessing news feeds through an institutional terminal.

Cons

As a specialised tool, it provides news data only and lacks any other financial market data (like stock prices or fundamentals). It is a raw data feed that requires technical expertise to implement, not a ready-to-use news interface.

Pricing

Offers a free plan for development and testing. Paid plans are scalable based on API call volume and features, starting from around $99 per month.

USP

Its singular focus on providing a powerful, flexible, and affordable way to programmatically search and integrate structured news data from across the globe into any application.

Conclusion

By embracing this "pick and mix" approach, you can assemble a more cost-effective, modern, and flexible toolkit that is perfectly tailored to the specific demands of your workflow.

Try BlueGamma free for 14 days or request an API key if you'd like to try our powerful Interest Rate Data API.

.png)